By Yixiang Xu - University of California, Berkeley; Rupalee Ruchismita - University of California, Berkeley

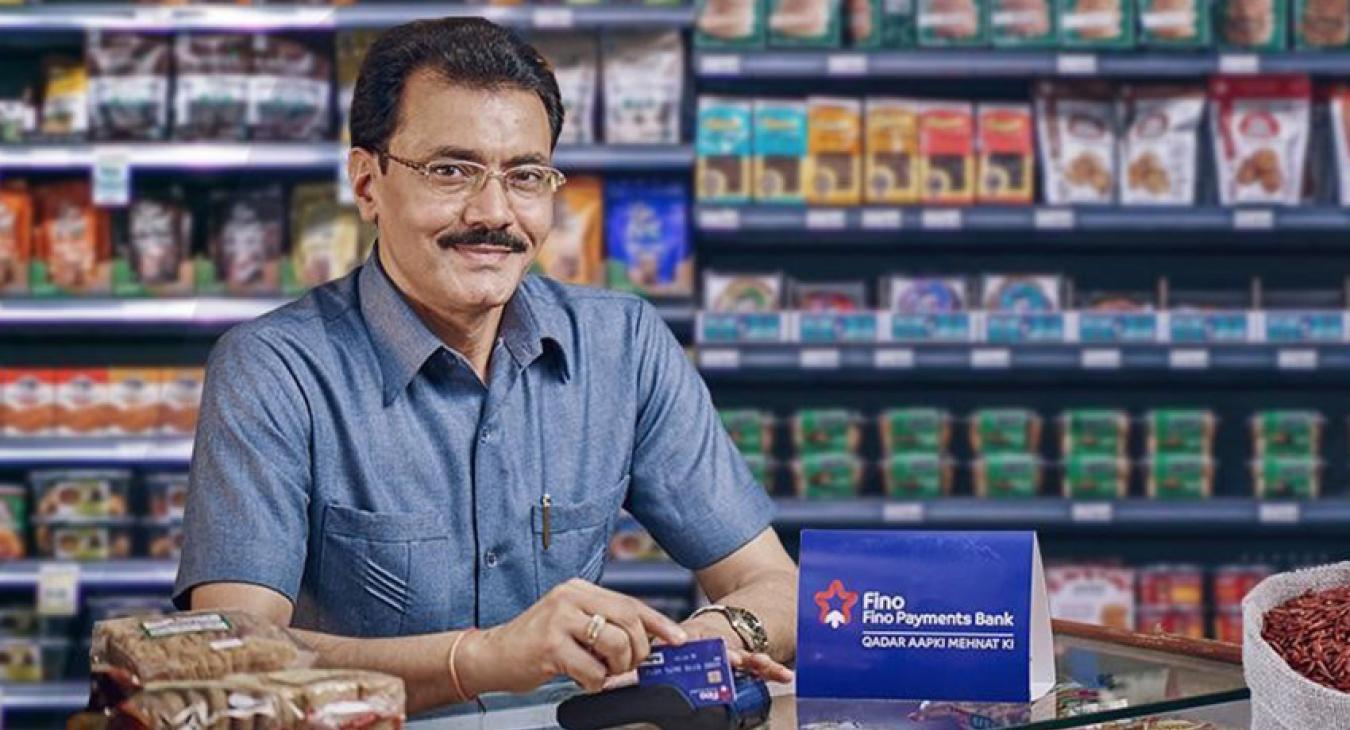

In a world where approximately 1.4 billion people remain unbanked, providing last-mile banking services remains a critical challenge, even with advancements in technology. In India's remote areas, local shop owners who double as micro-fintech agents are often the unsung heroes bridging the gap. Yet, despite their important role, many struggle to provide consistent financial services, with over 30% of these merchants dropping out before completing even a single transaction.

This blog explores how integrating cutting-edge technologies like Large Language Models (LLMs) and Generative AI are revolutionizing financial inclusion by supporting these local merchants and fostering economic growth in underserved communities.

The challenge: merchant dormancy restricts financial access

In remote areas, last-mile financial services are heavily dependent on FinTech firms and local merchants acting as banking correspondents. However, many of these merchants become inactive, a phenomenon known as market dormancy, due to a lack of relevant business insights and market knowledge. This undermines the sustainability of financial services in these regions, hindering economic development.

For many local shop owners, serving as FinTech agents is more than a side hustle; it is a vital opportunity to provide essential services to their community. However, without proper guidance and adequate support, they struggle to maintain profitability, leading to frustration and eventual dropout. Addressing this challenge is crucial for building a sustainable and inclusive financial ecosystem.

The solution: AI-driven personalization for FinTech agents

To tackle this issue, we have developed an AI-powered solution that offers personalized support to micro-FinTech agents in data-scarce environments. By leveraging LLMs and Generative AI, we deliver timely and relevant information that empowers agents to thrive in their roles.

Key Innovations:

Affordable merchant advice with AI: Generative AI is used to create tailored video and text content, closing information gaps for agents. Fine-tuned LLMs provide written content and lip-sync AI for video, ensuring that the information is easily digestible and accessible for merchants.

Smart content matching: Instead of broadcasting generic information, our AI dynamically matches agents with highly relevant, market-specific content. This ensures that merchants receive insights tailored to their needs and local market conditions.

Seamless integration with popular platforms: By integrating with WhatsApp, a widely used communication tool even in low-data environments, our solution ensures that merchants can access critical content regardless of technological constraints.

Data-efficient personalization: In emerging markets, where large datasets are fragmented or non-digitized, our approach requires minimal local data for personalization, reducing biases often associated with LLMs trained on data from developed regions.

Real Impact: results from our pilot in India

With funding support from ReFinD and other grantors, we conducted a five-day pilot involving 30,111 merchants in India, divided into control and treatment groups. The treatment group received personalised AI-generated content via WhatsApp, offering daily market-specific product insights.

The pilot yielded encouraging results:

- 12.8% increase in merchant engagement

- 25.1% increase in content completion rates

- 55.8% increase in positive feedback, with merchants expressing appreciation for the content's usefulness and a desire for more.

Scaling up for greater impact

Encouraged by the success of our pilot, we are now preparing for a 90-day intervention to assess the long-term impact of AI-driven support on merchant business outcomes and access to banking services. We aim to deepen our understanding of how these technologies can sustainably influence financial inclusion over time.

Join us in shaping the future of financial inclusion

Our initiative lies at the intersection of AI innovation, financial inclusion, and social impact. As we scale up, we invite partners to collaborate in leveraging technology to drive economic growth and empower underserved communities.

Together, we can transform financial inclusion from a vision into a reality for millions across India and beyond. Let us work together to equip local FinTech agents, create meaningful change, and build a more inclusive financial future for all.