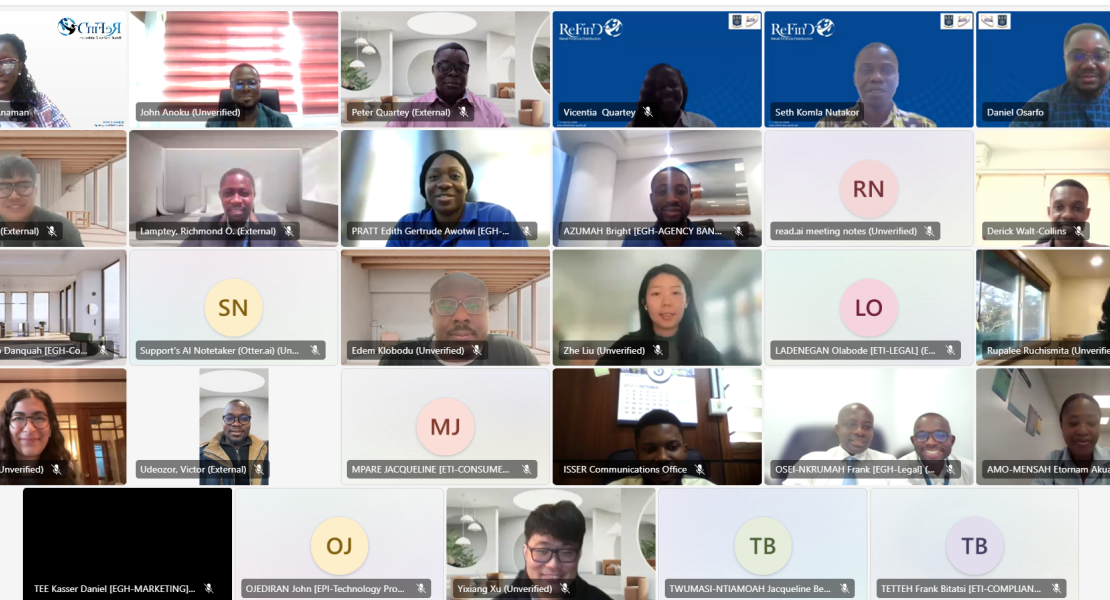

ReFinD Executive Director Prof. Peter Quartey leads the December 3 inception workshop, bringing together new grantees to foster collaboration for advancing financial inclusion in LMICs

ReFinD has awarded grants to nine innovative projects in its third funding round, expanding the initiative’s total portfolio to 29 funded studies. The selected projects span Sub-Saharan Africa, Southeast Asia, and South Asia. This diverse geographical representation reflects successful outreach efforts to attract high-impact research proposals from traditionally underrepresented regions.

Prof. Peter Quartey, ReFinD's Executive Director, led an inception workshop on December 3 to formally welcome the new grantees. The session served multiple purposes, including introducing grantees to ReFinD's mission and objectives, clarifying expected deliverables and timelines, outlining the initiative's communication strategy, and facilitating collaboration between grantees and the ReFinD team.

The funded projects address key challenges in financial inclusion, ranging from enhancing agent banking connectivity in Indonesia to developing effective agent selection methods in Niger's emerging mobile money market. These projects were selected through a competitive process that drew applications from 14 countries.

Building on ReFinD's commitment to expanding financial access, the new projects promise to generate actionable insights for strengthening agent networks and advancing financial inclusion across developing economies. The ReFinD team looks forward to supporting this new cohort of grantees as they contribute to the vital mission of developing evidence-based solutions to drive financial inclusion in low- and middle-income countries (LMICs). ReFinD extends its sincere appreciation to all researchers who submitted proposals under this funding round.

Below is the list of projects funded under the third ReFinD funding round:

Competition for transparency: A randomized experiment in Ghana

Institution: University of California Berkeley

Country- Ghana

Category – Greenfield

Enhancing connectivity for agent banking: A pilot study on satellite internet for expanding the network of digital finance retail agents in rural Indonesia.

Institution: Loughborough University, UK

Country: Indonesia

Category: Pilot

Contract transparency and agent misconduct: Evidence from digital finance retail vendors.

Institution: ISSER

Country: Ghana

Category: Proposal Development

Identify good agents in a nascent mobile money market

Institution: Tufts University

Country: Niger

Category: Proposal Development

Tackling productivity losses in mobile money Services: The role of agent well-being

Institution: Queens University

Country: Ghana

Category: Proposal Development

Addressing dormancy among micro-fintech agents in India: A scalable personalization approach

Institution: University of California Berkeley

Country: India

Category: Extension

Optimizing subsidy allocation in two-sided markets: Evidence from digital payments

Institution: University of California Berkeley

Country: Ghana

Category: Pilot

Deepen the understanding of banking agent operations and undertake research interventions

Institution: Ecobank

Country: 33 countries

Category: Pilot.